# How to Deposit Tokens to a Liquidity Pool?

WX Network liquidity pools is a service that provides liquidity for smoother trading on WX Network. You can invest in a liquidity pool to become liquidity provider and start earning passive income.

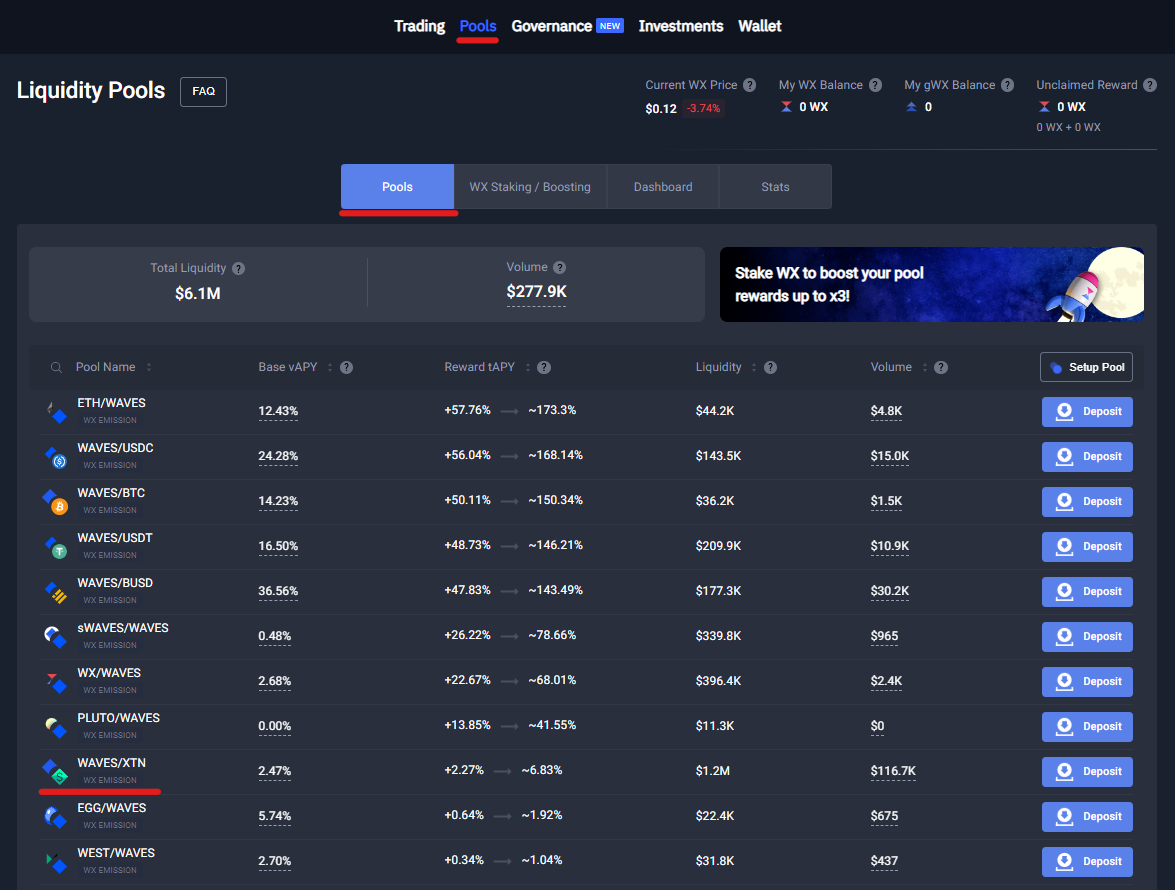

To do so, open WX Network (opens new window) app, login to your account and navigate to the Pools (opens new window) tab.

Select a pool to invest in from the list and click Deposit. You can also create pools with tokens that have 'Community Verified' label (opens new window).

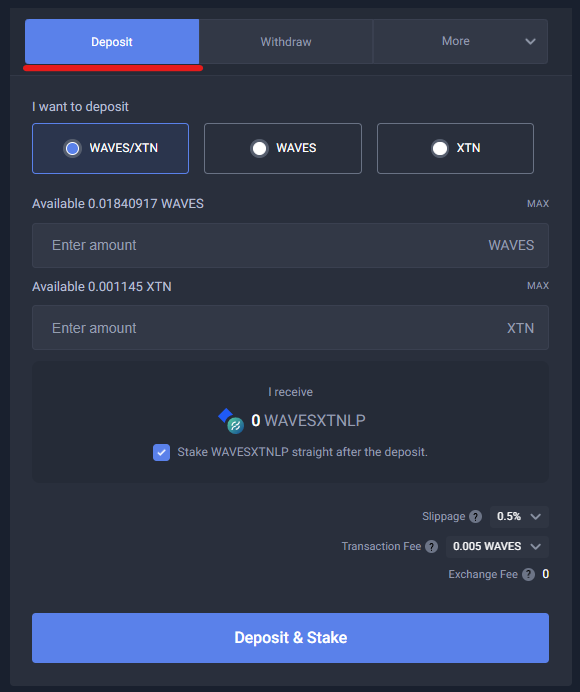

Liquidity pools require investments in two tokens, for example, if you select WAVES/XTN pool, you will need to invest WAVES and XTN at the same time.

Note: You can optionally deposit/withdraw one (any) token of the pair. Withdrawals with one token implies Exchange Fee that is charged for the token exchange.

On the screen that opens specify the amount of WAVES that you want to invest. When you specify the amount of the first token, the system will automatically specify the proportional amount of the second token.

Note: Make sure that you have enough tokens to invest and pay the transaction fees. How to get Tokens on WX Network?

The amount of LP token that you will receive will be displayed in the I receive field. You can automatically stake the received LP token to get regular staking rewards in WX token, to do so select Stake WAVESXTNLP straight after the deposit checkbox.

Specify Slippage. During the deposit operation, the price of the received LP token may change significantly. If the price fluctuation exceeds the specified Slippage, then the transaction will not happen and your tokens will be returned.

Click Deposit & Stake (Deposit) to continue.

If you selected Stake WAVESXTNLP straight after the deposit checkbox, then your daily staking reward in WX token will be accumulated on the contract. You can claim your WX at any time. How to Claim LP Staking Reward in WX?

If you have not selected Stake WAVESXTNLP straight after the deposit checkbox, then you can stake your LP tokens manually to make extra profit in WX token. How to Stake LP Tokens?

Important: Please note the impermanent loss that is the inherent risk of providing liquidity to pools and it directly depends on the volatility of a trading pair. Therefore, if you want to minimize potential losses, you can invest in stable pools such as USDC/USDT. Read more about the impermanent loss (opens new window).

# How to Withdraw Tokens from a Liquidity Pool?

The price of an LP token grows over time because the liquidity pools make profits from trading activity and accumulate them in the pool.

You can withdraw your tokens from a liquidity pool at any time. When you do so, your LP token will be automatically exchanged to the tokens that you originally invested. The exchange will happen at a new price and you will receive your profit that the liquidity pool made and collected for you over time. The difference between LP token price when you invest and the new price when you withdraw is your profit (Base vAPY).

Note: You can optionally deposit/withdraw one (any) token of the pair. Withdrawals with one token implies Exchange Fee that is charged for the token exchange.

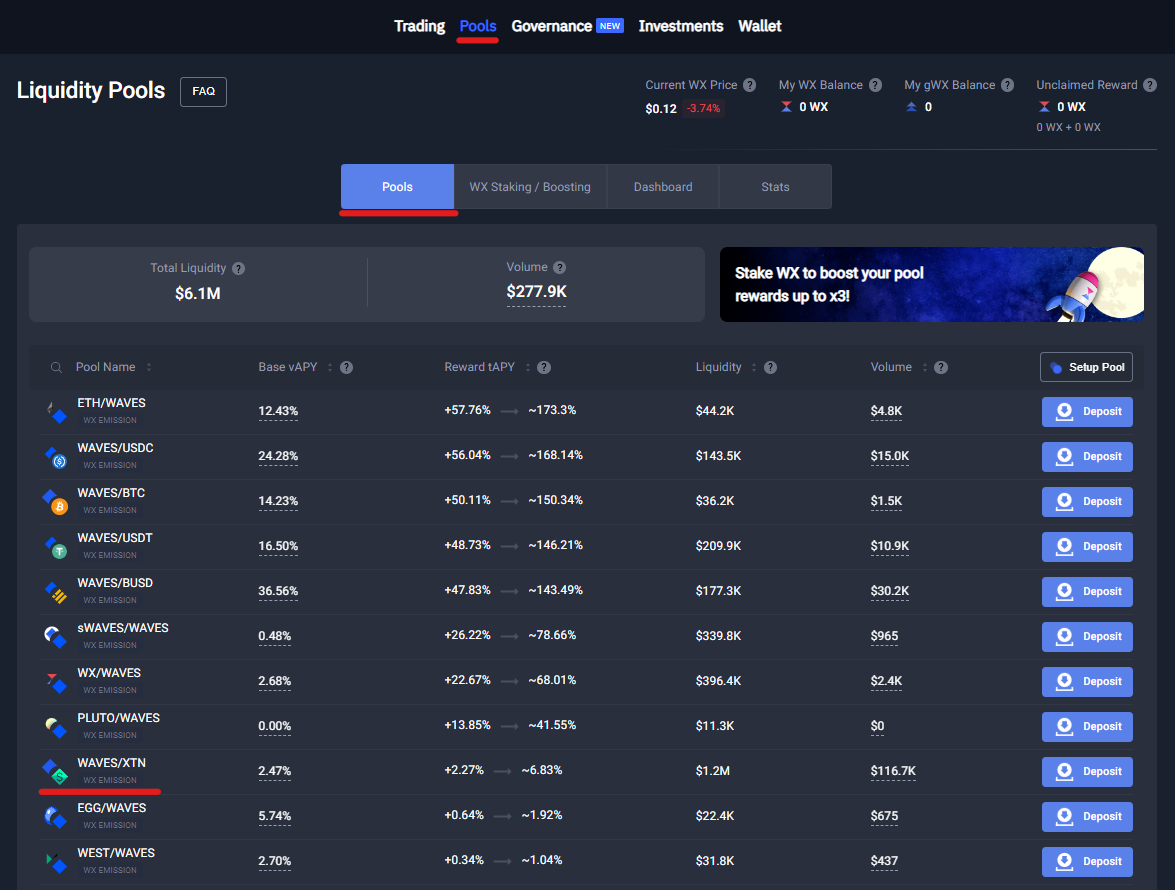

To withdraw tokens for a liquidity pool open WX Network (opens new window) app, login to your account and navigate to the Pools (opens new window) tab.

Select a pool to withdraw tokens from and click on it. For example, WAVES/XTN pool.

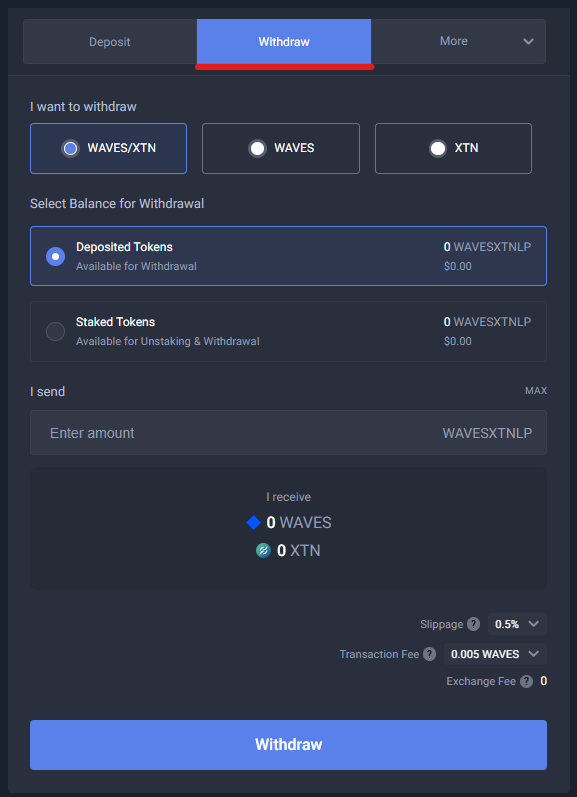

On the screen that opens select Withdraw tab and specify the amount of LP token that you want to exchange back to the original tokens.

Note: You can unstake and withdraw your deposit with a single transaction. To do so, select Staked Tokens radio button.

The amounts of the tokens that you will receive will be displayed in the I receive field. Please note, that the amounts may differ from what you deposited due to the changing of the prices of the tokens since the moment of the deposit.

Specify Slippage. During the withdrawal, the price of the LP token may change significantly. If the price fluctuation exceeds the specified Slippage, then the transaction will not happen.

Click Withdraw (Unstake & Withdraw) to continue.